Dear David,

I had no idea that you would have such an emotional reaction to my POV on the Colorado shootings, and had I known I would without hesitation have chosen a different topic. But having written it without such knowledge, I stand behind what I wrote, and I have added links to studies supporting my views. Perhaps your feelings have prevented you from reading what I actually wrote, and led you to paraphrase my article in a misleading way. You claim I stated “that one of the murderers, who had been questioning his gender identity at the time of the crime, was the result of our society ‘brainwashing teens into gender dysphoria.’” Only the last 5 words are mine.

If you are implying that I think all teens confused about their gender are potential mass murderers, I am offended more by your lack of respect for my intelligence than anything else. Having expressed my outrage more than once at suggestions that all “white nationalists” are mass murderers, I am not likely to make the same mistake in causality myself.

Do I think that the massive propaganda machine legitimizing the desire to change sex is harmful, and that it added to the impulses that made this boy and girl into killers? Indeed, I do. Capable researchers have published studies that reveal a link between peer and social media pressure and gender dysphoria. That is a matter of fact to be discussed not suppressed.

You clearly disagree with me that great harm is done by teaching that changing one’s physical sex is healthy and therapeutic. That is no reason to prevent me from offering my opinion, which has its own scientific support, any more than you would prevent me from stating my opinion that the scientific basis for claims of imminent climate catastrophe is weak.

Moreover, I never said or thought that the shooters were themselves evil, for their gender confusion or for their murderous intentions. That is not for me to judge.

What I actually wrote is: “The clear evil is in the politicians, “educators,” fashionable psychologists and institutions that are brainwashing teens into gender dysphoria. Teenagers, confused by hormones, immaturity and no doubt family and social pain, are being told that their all too common emotional distress comes from being the wrong sex and that they can solve their problems by changing their dress, bathroom access or biology. It doesn’t work, and creates the even worse problems seen in this event.” By deleting my column, you made it impossible for readers to judge my meaning for themselves.

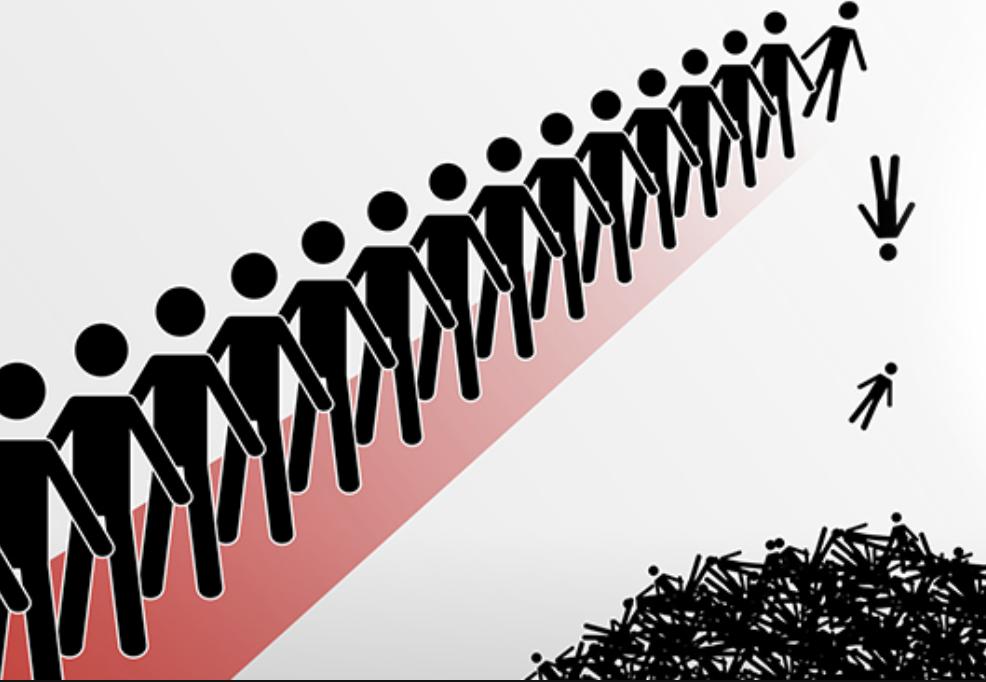

What I identified as evil are the institutions telling teens that their wishes to have been born with a different biology are healthy and need to be fulfilled. I am convinced that adding the suggestion that “you are the wrong sex” to the sometimes overwhelming stress of puberty and the mismatched timing of hormonal and intellectual development can make life more than a teen can handle. Some choose suicide, many suffer impaired mental health, and in this case two chose mass murder. Perhaps if I had written that rather than the shorter “creates the even worse problems seen in this event” you would have understood me better.

What I find most strange is where you draw the line on what is permissible speech. I’m sorry, this is not even close to “shouting fire in a crowded theater.” In Canada or the Netherlands, I realize, I could be put in jail for “hate speech” for writing this column. That is one reason why I am so thankful to live in the USA.

You say that my words were doing harm. In my opinion, being silent on the tragic consequences of driving our youth into confusion about gender also does immense harm. The question is not what is comfortable but what is true. Though truth may be one, agreement on what is true only comes from listening to statements that cause discomfort. Your and some readers’ attacks on me certainly hurt my feelings, but the reassurance of others that my column was reasonable comforted me.

Your standard seems to be the same “safe space” guarantee that has become notorious on campuses. Perhaps you should add a “trigger warning” to my Points of View. I have become accustomed to prejudice based on my race, gender and age, to insults directed at my religion, and to lies about what I have said and done. I did not and do not expect protection from any of this. Why do we accept the idea that some are so privileged that they should hear nothing but praise?

I am also distressed and puzzled, not for myself but for the readers of the Spy, by your statements about what the Spy supports. Do you mean to say that after suggesting I write about candidate Buttigieg’s appeal to Christianity to support his homosexual lifestyle, you would censor me if I stated my belief that marriage is an institution (or sacrament) ordained by God to unite a man and a woman for life? That is what is said in the Catechism of the Catholic Church and was the universal teaching of Christian churches for almost two thousand years, but it is also termed hate speech in many venues. You should clarify where censorship starts in the Spy.

Unless you do intend to silence all views but your own on these issues and to leave standing the regrettable charge that I am a purveyor of hate speech, I hope you will publish this response to your attacks on me in full.

Respectfully,

David Montgomery