Len Foxwell, the veteran political strategist who until recently was the longtime top adviser to Maryland Comptroller Peter V.R. Franchot (D), is setting up his own communications shop.

Foxwell on Thursday is set to announce the creation of Tred Avon Strategies ― a firm named after the Tred Avon River, a tributary of the Choptank on the Eastern Shore, where Foxwell grew up and lives.

“As the founder, principal and only full-time employee of this new firm, I’m excited about the chance to put my 25 years of experience at the highest levels of Maryland politics and government to work on behalf of my clients,” Foxwell says in a Facebook post that’s due to go live Thursday morning. “Whether you are a business owner trying to survive the most volatile economy of our lifetime, an aspirant for political office, or a community advocate who is fighting for meaningful change, I’ll be there for every step of your journey.”

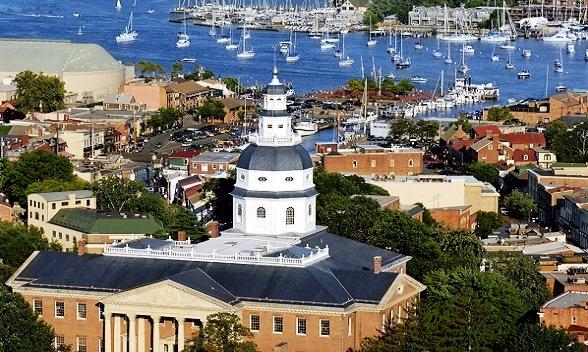

Foxwell will work out of the Annapolis office of Capitol Strategies, LLC, the lobbying firm at One State Circle, across the street from the State House. His firm will have an administrative relationship with Capitol Strategies but will otherwise be an independent entity.

One of the partners at Capitol Strategies is Sushant Sidh, Foxwell’s brother-in-law. Foxwell in his Facebook message refers to Sidh and Capitol Strategies’ other principal, David Carroll, as his “strategic partners.”

Foxwell was asked to resign as Franchot’s chief of staff earlier this fall, following the former’s admission of a personal indiscretion. He had been the comptroller’s top aide since 2008 and had been advising Franchot ― formally or informally ― for almost two decades.

Foxwell has been an integral part of Franchot’s political rise, and the comptroller earlier this week announced that he had hired the Baltimore-based consulting firm Tidemore Strategies to be his principal advisers for his 2022 gubernatorial campaign.

But Foxwell also became a lightning rod for controversy in recent years, with provocative social media posts that attacked Democratic leaders and conservative Republicans.

Foxwell’s career began well before his time with Franchot. He served in a variety of political and policy roles under former Gov. Parris N. Glendening (D); worked on the gubernatorial campaign of former Lt. Gov. Kathleen Kennedy Townsend (D); was community and government relations director for Salisbury University, his alma mater; and was director of government relations for the Greater Washington Board of Trade. He also teaches a communications course at Johns Hopkins University.

Foxwell has also offered informal advice to scores of politicians, including Gov. Lawrence J. Hogan Jr. (R), community groups and business entities ― especially the state’s craft brewery industry, which Foxwell and Franchot have fiercely championed.

Tred Avon Strategies’ new website features testimonials from state Sen. Mary L. Washington (D-Baltimore City), Salisbury Mayor Jacob Day, and Julie Verratti, co-owner of Denizens Brewing Co., which has tap rooms in Silver Spring and Riverdale.

Foxwell is hanging his shingle at the start of a consequential election cycle in Maryland and his services could be quite sought after.

In an interview, Foxwell said he had signed up a few clients but wasn’t prepared to name them yet.

“I’m going to allow them to announce our relationship on their own timeframe,” he said.

By Josh Kurtz