This video is about 31 minutes long.

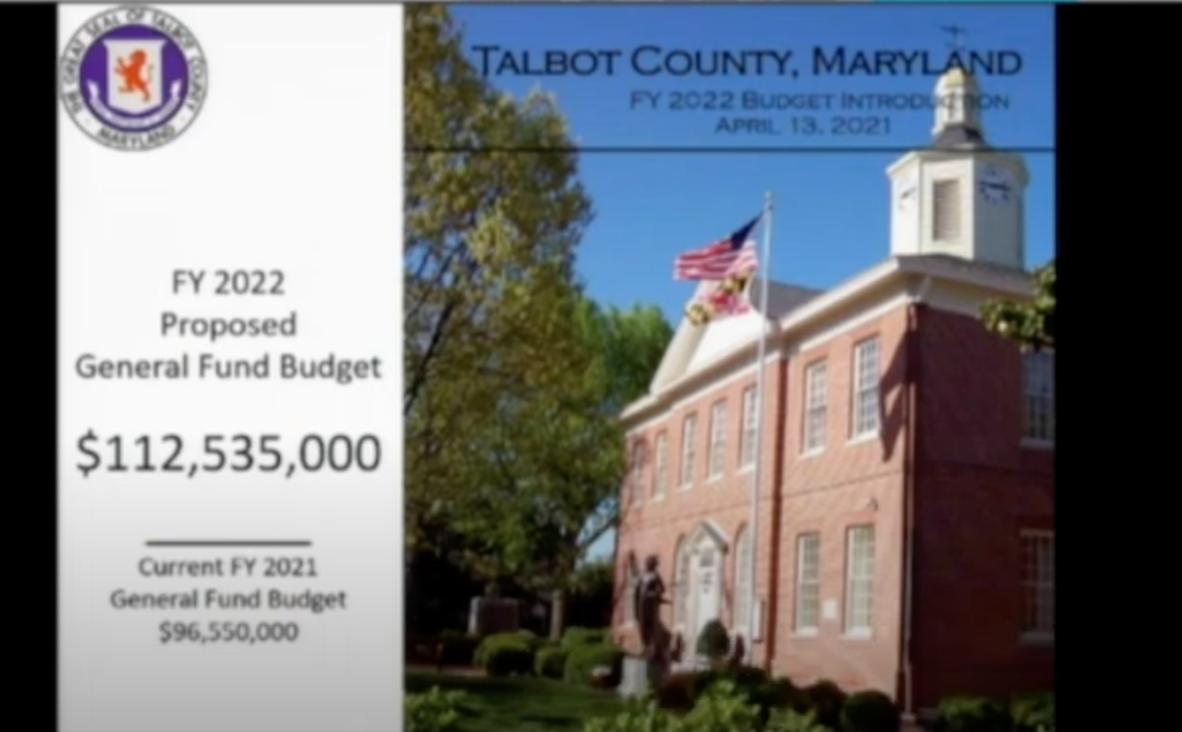

The county council has introduced a $112.5 million budget for the coming fiscal year, up substantially from this year’s $96.5 million budget.

But much of the increase is slated for long-delayed capital projects, including $5 million set aside for a new public safety center. The center would house the Talbot County Sheriff’s Office and related agencies.

All five members of the Talbot County Council introduced the Fiscal Year 2022 budget. Public hearings on the budget, which is Bill 1473, are set for 2 p.m. Tuesday, May 4 (to be held virtually) and 7 p.m. Tuesday, May 4, in the Easton Elementary School cafeteria at 307 Glenwood Ave.

Written public comments may be emailed to [email protected] or mailed to County Council, Courthouse, South Wing, 11 N. Washington St., Easton, MD 21601. The public is encouraged to submit written comments by Monday, May 3.

The budget includes a 1-cent increase above what is allowed under Talbot’s property tax cap. Voters okayed a measure allowing for the rate increase in the November election.

The county’s proposed real property tax rate (outside of incorporated towns) is $0.6529 per $100 of assessed value. The county rate is slightly lower for properties in the town limits of Easton, Oxford, Queen Anne, St. Michaels, and Trappe.

Angela Lane, the county’s finance director, said Tuesday that the general fund budget is 16.56% higher than this year’s, but most of the $16 million increase is for capital projects, capital outlay, and equipment purchases.

Operating expenses would increase less than 4%, she said.

Talbot County Manager Clay Stamp said the strategy for the FY2022 budget included capital projects and retention and recruitment of county staff, particularly in public safety — the sheriff’s office, detention center, and emergency medical services.

“When you look at the budget, we’re looking at a … modest increase in the operational line item of the budget, and clearly an investment in our capital improvement projects,” Stamp said. “(T)he capital improvement program is an investment into our future and frankly a number of the projects in this are long overdue and need to be addressed, and just merely by engaging this level in this program we are trying to … stimulate economic development as well.”

Council Vice President Pete Lesher said the county council made a commitment when asking voters to change the tax cap.

“And we said, where there is a critical need is in … public safety, and it’s both in the capital needs with the construction of the sheriff’s office on the horizon, but also … the recruitment and retention of our officers and the aspects of this budget that have to do with public safety salaries, not only sheriff’s office but in emergency services and so forth, all of those public safety functions,” he said. “We’re making a real commitment.

“(T)his I believe is a responsible and sustainable budget, and is fulfilling — as we made that commitment to the public — those critical functions and funding them going forward,” Lesher said. “We heard from the public that these are important, these need to be funded. And we’re true to our word here, this is where this money is going.”

Councilman Frank Divilio said he was nervous about such a big increase.

“I know that we’re making some huge improvements, both in traffic and safety and in all departments, but it comes at a time when money isn’t just freely flowing, if you look around and businesses are either closed or hiring right now, it’s a very odd time,” he said. “And I am very nervous because I know we still have the road to recovery to come out of this and we’re not … there yet.

Councilman Corey Pack said council members knew that long-delayed capital projects needed to be funded.

“Several of us knew that these capital expenses were going to come due, and we’re going to have to step up and pay for them,” he said. “I think the way that this budget is set up, yes there is a large increase, but we look at the operational side … less than a 4% (increase)…, and that’s the part that keeps eating, the operational side.

“But it’s not reckless spending, and it’s not an increase just for the sake of increase…. We had to do some things on the capital side that we knew that we’re gonna have to pay,” Pack said. “We had to do some things on the operational side when it comes to retention and recruitment and keeping good quality people here. So, this is the price you have to pay to do business in the 21st century.”

Councilwoman Laura Price recalled her first year on the council “when we had to cut a budget and slice and dice and it was painful because the county had, … in the two years prior, … used $17 million in fund balance.”

She noted capital projects require separate approval after budget passage.

“(P)eople need to know that any capital spending requires a whole separate bill to truly authorize the expenditure,” Price said. “So it’s ready to go, but we haven’t, you know, spent that yet.”

Bill 1473