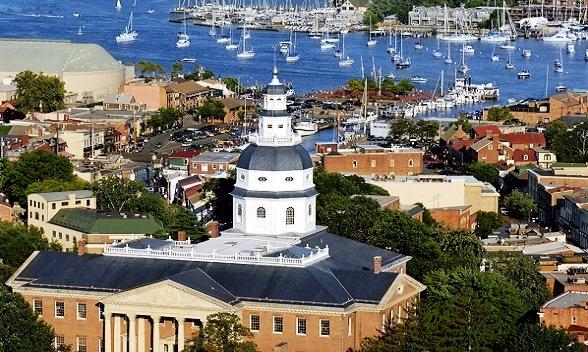

Week three is wrapped up in Annapolis and things are just really getting started. As Senate President Bill Ferguson noted that the rapidly-growing bill lists and committee workloads “kicks off the real first day of the 2020 session.” We reviewed twice as many bills as last week, 32 in all. There will be hundreds more to come!

I believe we dodged a bullet on HB292/SB229 “Toll Roads, Highways, and Bridges, County Government Consent Required – Expansion.” This bill came up last year and was written to expand the authority to all 24 jurisdictions. It would prohibit the State from constructing a toll road without the consent of the majority of “affected” counties. This was interesting, because the original bill was written about 1978, soon after the completion of the second Bay Bridge. It was written to protect the nine Eastern Shore Counties. There is an AG letter of opinion that interprets “affected” to mean the county where the project lands. Well in 1978, there were only two toll roads in the State. The Harbor tunnel and the Chesapeake Bay bridge. To try to piggyback on an old bill and expand this to all 24 counties to a toll road, such as the I-270/495 corridor is inappropriate. A separate piece of legislation should be drafted and introduced and leave this existing law to stand alone.

I attended the Senate committee hearing to listen to the testimony. Talbot, Queen Anne’s and Kent did not feel we needed to testify since MACo submitted technical amendments to leave us out instead of taking a position. This is especially important right now, since the NEPA study is ongoing and currently lists these three counties as potential “landing” counties for a third Bay Bridge span. Chairwoman Delores Kelly seemed to have several problems with the bill and there were tough questions asked at the hearing. I do not expect it will pass the Senate. There is still a House hearing in a couple weeks, but hopefully it will die and then a separate bill could be drafted for next year if appropriate.

An update on HB223, “End Ineffective Business Subsidies Act” that MACo held open. I wrote in detail the problems last week. I am happy to report that MACo is officially opposing the bill. There is much opposition, but we will have to wait and see if it gets enough traction to pass.

There are a couple bills related to taxing authority on both vaping and tobacco products. HB400 “Vaping Product Tax” would impose a 30% tax from the wholesaler to the distributor on vaping products and require the revenue be used for the State Reinsurance Program. It would also authorize a county to impose a local tax. This is noteworthy, because counties have never had the authority to have a local tax on cigarettes/tobacco in the past. SB3, “Electronic Smoking Devices, Other Tobacco Products and Cigarettes – Taxation and Regulation,” would also expand taxing authority to local governments. MACo supported both of these bills, although the local taxing pieces do not have much chance of passage. It would be helpful for locals to have more taxing authority, especially in the face of “Kirwan” – the massive mandated increase in education spending, otherwise we will be faced with huge increases in property and income taxes. (We are still awaiting introduction of the Kirwan bill)

HB582/SB232 “Procurement – Prevailing Wage” would be an extremely harmful bill on local budgets. Typically, this affects us because prevailing wage must be used when a school construction project has more than 25% funded by the state and even that was lowered several years ago from a

50% funding level. This bill would repeal that and apply prevailing wage to any project funding in whole or in part with State funds. Meaning if you take $1 from the state, you must pay the prevailing wage. To give an example of the increase in the cost of a project, I will use our new Easton elementary school as an example, even with current law. It is a $50 million project, if we had been able to use a normal wage, more appropriate to a rural Eastern Shore county (and not based on an inflated Montgomery or PG county wage rate), the project could have been about $10 million less. I can’t even imagine the cost increases if HB582 were to pass.

There were more than a half dozen “subtraction modification” bills we opposed with our general statement this week. MACo believes that if the state wants to give a tax break to a person or group, that it should be done through a state tax credit and not through a “sub-mod” that reduces our income tax revenue. Again, especially in light of the education bill that will be forthcoming. Even worse for local budgets is HB411 “Homestead Property Tax Credit Calculation.” This is a repeat from 2019 that MACo strongly opposed again. I wrote last year “This would open up and require that any first- time homebuyer in the State of Maryland be transferred the existing tax savings of the previous owner. This might seem like a good incentive to make property taxes more affordable, but totally ignores and undermines the purpose of existing law. This tax credit was created so that as a home appreciates in value, as long as the homeowner lives in the home, the homeowner will not be priced out of retaining that home because of an increased assessment, which ensures stability in their future tax bills.”

We heard an overview of the State budget from Vicki Gruber of DLS (Department of Legislative Services). Basically, the General Fund budget starts with -$579 million. The Governor submitted a budget with various transfers and revenue sources and the General Fund would end with a balance of $108.5 million if everything goes through successfully. More concerning is the structural deficit over the next 5 years. Ms. Gruber gave us two charts that showed the forecast both in an expanded growth scenario and with a fiscal slowdown. She also included projections including the cost of “Kirwan.” In the expanded growth scenario, the structural deficit is -$37 million in FY21, which grows to -$1.07 billion in FY25. When adding Kirwan costs, it grows to -$1.644 billion dollars. If our economy does slow down, the projections get worse. In FY21, the deficit is -$251 million. By FY25, the total structural deficit, including Kirwan is -$2.242 billion. These are staggering numbers.

We also got updates from staff on ongoing issues. The big win we all cheered is on Small Cell (5G) legislation that was introduced last year. What is 5G? Let’s start with what is 3G, which means connecting your computer to the internet. 4G means connecting your smartphone to the internet. 5G means connecting everything to the internet. Estimates project that we will grow from 2 or 3 connected devices per person to 40-100 connected devices per person. There were two competing bills in 2019 and the Industry bill would have allowed them to deploy these refrigerator size cells anywhere with no local zoning oversight or appropriate fees. We beat the bill last year and there has been no bill introduced this year. We are the first state in the Union to have beaten the industry on this issue! That’s how powerful MACo can be and how important it is for us as local elected officials to stay engaged in what happens in Annapolis and to fight for what is in the best interests of our citizens.

Laura Price is 2nd Vice President on the Executive Board of Directors of MACo, Chair of Budget and Tax, Talbot’s legislative liaison and member of the Talbot County Council.

Write a Letter to the Editor on this Article

We encourage readers to offer their point of view on this article by submitting the following form. Editing is sometimes necessary and is done at the discretion of the editorial staff.