During a Friday visit to Easton, Maryland Comptroller Peter Franchot spoke via videoconference with The Spy.

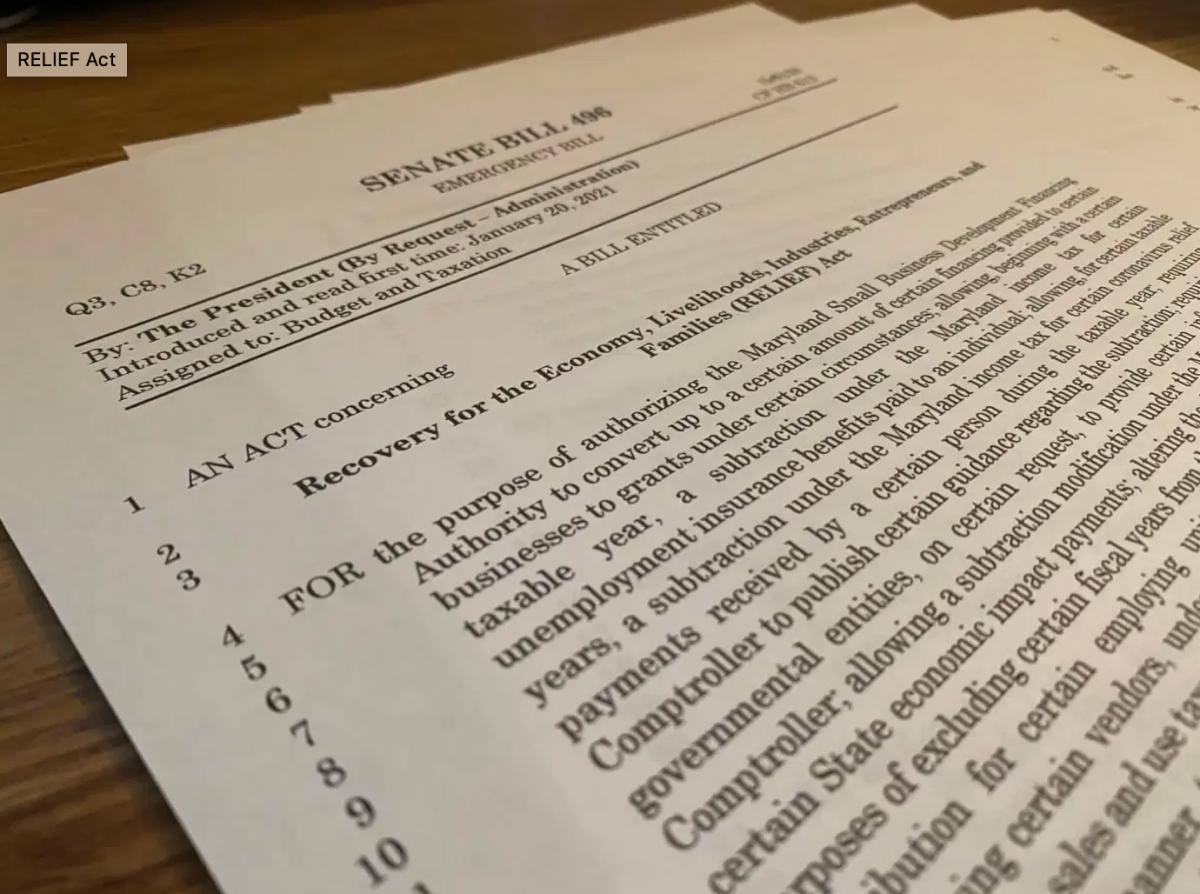

Franchot talked about Maryland’s tax season, which began Feb. 12; the state’s COVID-19 stimulus checks, processed by his office; and how Maryland’s economy looks after nearly a year of the pandemic.

This video is about 18 minutes long.