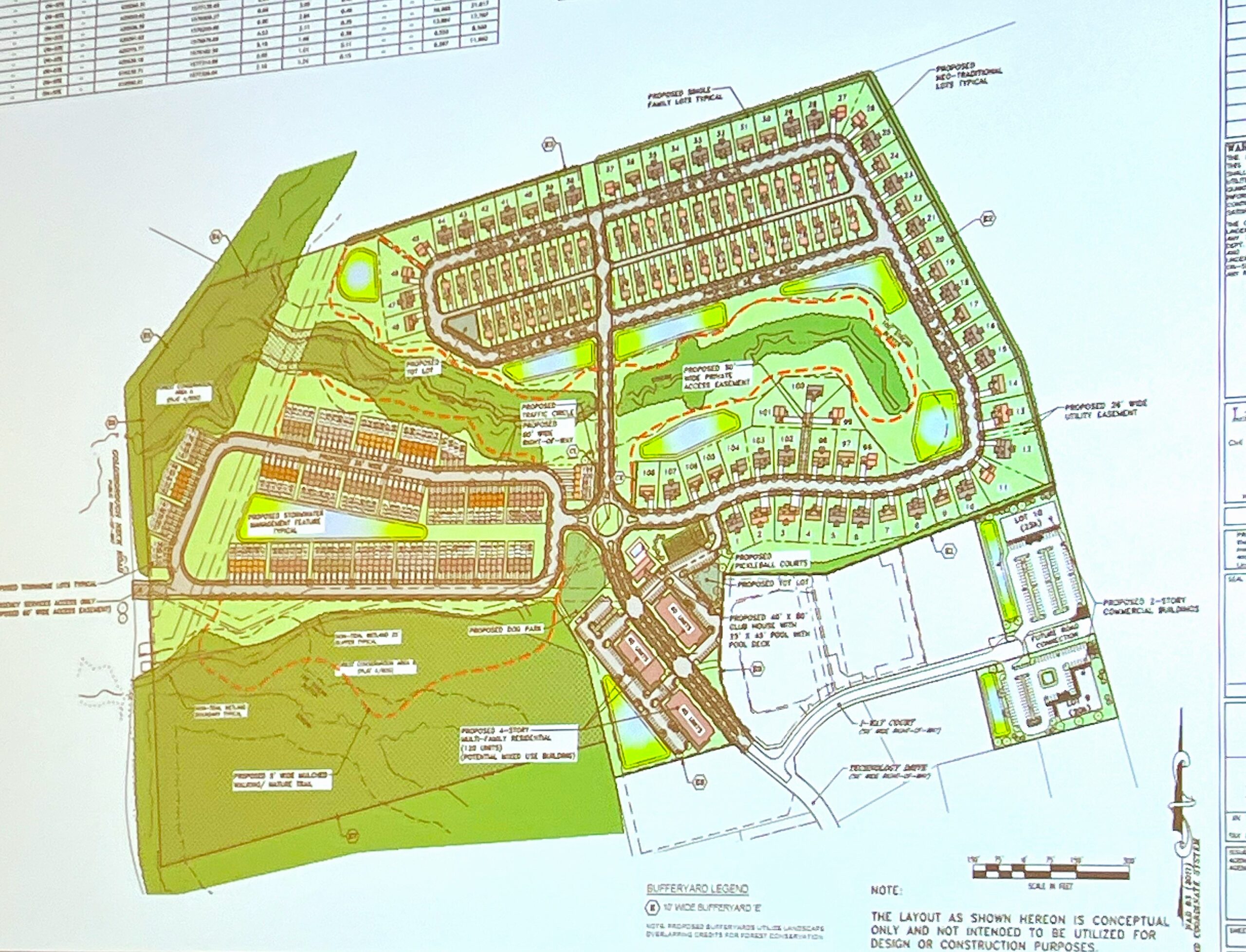

The Fox Chase Estates project would bring 365 housing units to north Easton.

On July 17, Easton’s Planning Commission voted 5-0 to reject the proposed Fox Chase Estates, a mixed-use development planned for 1.6 million square feet near Easton Airport and the forthcoming University of Maryland Shore Regional Medical Center on Route 50 to the town’s north.

The project, which includes 365 residential units, 185 of which are designated as affordable housing, and commercial spaces including medical services, raised concerns over traffic, the danger of its proximity to the busy Easton airport, and inconsistency with the town’s Comprehensive Plan.

Attorney for the Fox Chase Estates project Lawrence Scott argued before the Commissioners that the project in fact aligned with the soon-to-be updated Comprehensive Plan by virtue of its diverse, affordable housing and mixed-use communities. He highlighted connectivity features, including a stub road to the hospital and a right-in, right-out intersection at Goldsboro Neck Road to minimize traffic.

Scott estimated the project would generate 60 percent less traffic than the 2,700 daily vehicle trips permitted under the site’s current industrial zoning, which permits 900 daily truck trips, and that improvements to the affected roadways are imminent in any case.

The attorney also said the project takes the environment into account with plans to preserve natural drainage, minimize tree removal, and meet county and state permitting requirements for roads and stormwater management.

Scott framed the development’s proximity to the hospital as an economic benefit, providing housing for a portion of the hospital’s projected 2,000 staff.

Residents raised significant objections, however, focusing on traffic congestion on Airport Road and Goldsboro Neck Road, where existing safety issues and poor intersection visibility already pose challenges. One commenter estimated the project could add up to 1,400 residents, straining roads, schools, and sewer systems.

Environmental concerns included potential flooding from developing farmland near creek beds, which could degrade water quality in the nearby Miles River.

Critics also argued the project’s layout, with low-, middle-, and high-income housing segregated, failed to meet the Plan’s goal of integrated neighborhoods. Commissioners agreed, citing the project’s misalignment with the Comprehensive Plan’s land use map, which designates the area for industrial and commercial use.

The proposal gets around this designation through a Planned Unit Development zoning mechanism, known as a PUD, that allows developers to bypass traditional restrictions by offering flexibility in land use and design.

Commissioners noted this conversion to residential use conflicts with Easton’s documented need for industrial space. They also questioned the project’s fiscal sustainability, warning that sprawling developments often fail to generate sufficient revenue for infrastructure maintenance.

Commissioners described the project’s dense, generic design as poorly suited to Easton’s vision for compact, connected neighborhoods and linked the aesthetic to “anywhere, USA.”

The Commission urged development of a sector plan to guide future growth near the hospital and ensure the area’s future aligns with Easton’s long-term priorities.

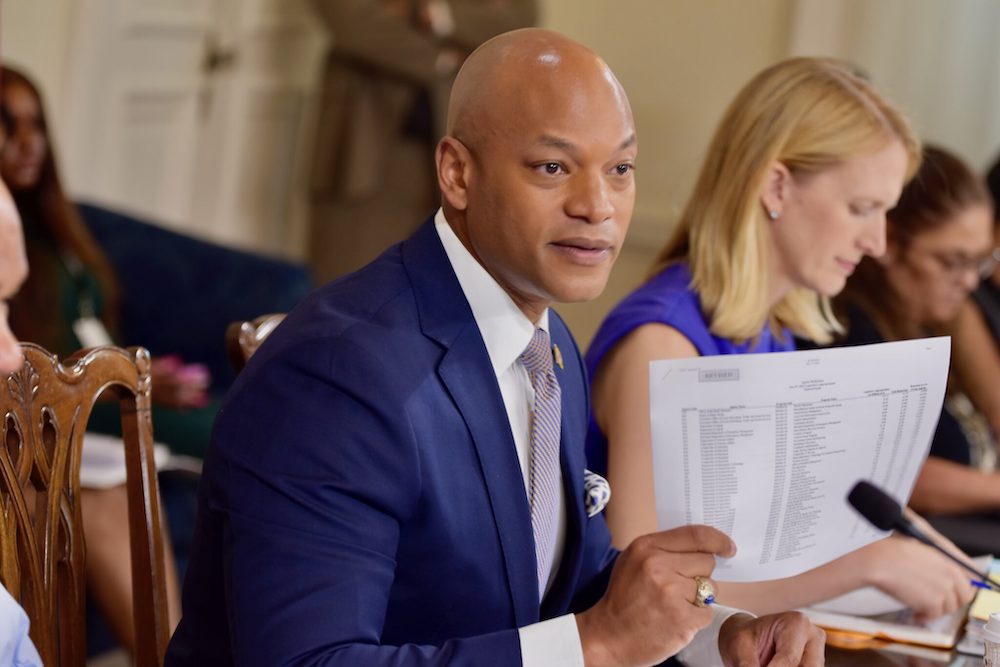

Town Planner Lynn Thomas explained that the commission’s non-binding recommendation will be summarized in a letter to the Town Council, likely presented at its August 4 meeting. The council will then schedule a public hearing, expected in September after the required two-week comment period.

Thomas noted that the Council typically defers to the Commission in cases related to Comprehensive Plan compliance, which he said figured strongly into the down votes due to the site’s industrial designation and the project’s incompatible design.

“The Commission’s recommendation has a lot of weight to it,” Thomas said, “but there are times when [it] has recommended approval and the Council voted against it, and vice-versa.”

After the hearing, Scott said his team was “disappointed that the Planning Commission’s analysis and recommendation did not dwell on affordable housing, economic development, and employment, but instead focused on issues such as housing type, yard size and connectivity to downtown Easton.”

He said that Fox Chase Estates was designed specifically to support the need for affordable housing in anticipation of Shore Regional Health, which is the largest economic project in Talbot County and the Town of Easton’s largest employer.

“As this project moves through the entitlement process with the Town of Easton, we will address the comments from the Planning Commission and look forward to the next step of presenting this much needed project to the Town Council.”

Tuesday’s vote was a decisive victory for opponents of the project, but not a final one. Like Yogi Berra said, it ain’t over till it’s over.